CME Group(CME)

Silver futures are currently traded at several exchanges including the CME Group (CME), the Tokyo Commodity Exchange (TOCOM), the Multi Commodity Exchange of India (MCX), with the COMEX silver contracts on the CME being the most actively-traded and the most influential. Due to high volatility of silver prices in recent years, trading in silver futures has surged, with trading in the COMEX silver contracts jumping 60.52 percent year-on-year in 2010 to 12.83 million contracts, or 1.995 million tons. In 2011, trading volume totalled 19.61 million contracts, or 3.049 million tons, up 52.87% from 2010.

Trading volume of COMEX silver futures between 2001-2011

Source:CME

Multi Commodity Exchange of India (MCX)

Established in Mumbai in November 2003, the Multi Commodity Exchange of India (MCX) currently represents a more than 80 percent share of India's commodity futures market. MCX has launched three silver futures contracts – the 1 kg Silver Micro contracts, the 5 kg Silver Mini contracts and the 30 kg Silver futures contacts. In 2011, trading in the 1 kg Silver Micro on MCX totalled 46.9 million lots, or 46,900 tons, becoming the world’s mostly actively-traded futures contact (lots). Trading in the 5 kg Silver Mini futures contracts totalled 46.8 million lots, or 234,000 tons, while trading in the 30 kg silver futures contracts totalled 24.4 million lots, or 733,000 tons, ranking No.2 and No.3 respectively.

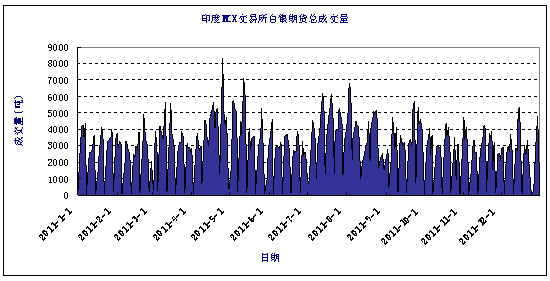

Total daily volume of silver futures traded on MCX in 2011

London Bullion Market Association(LBMA)

Headquartered in London, the United Kingdom, the London Bullion Market Association (LBMA) is a global gold and silver industry association in charge of the spot trading of gold and silver. LBMA is also a trade intermediary serving its members and participants in the London gold and silver markets. London is now the world's largest gold and silver over-the-counter market. LBMA's core customers and their members include the world's central banks, gold and silver producers, refiners, gold and silver processing enterprises and trade firms.

Shanghai Gold Exchange (SGE)

Shanghai Gold Exchange is China’s main marketplace for silver spot trading. Products being traded on the SGE include Ag99.9 and Ag99.99 spot trading, as well as spot margin trading for Ag (T + D) Silver trading became increasingly active in recent years. In 2010, trading in Ag (T + D) on the Shanghai Gold Exchange, totalled 73.551 million lots (or about 74,000 tons), worth about 386 billion yuan, up 353% and 559% respectively compared with the previous year. Trading became more active in 2011, with trading reaching 245.8 million lots (or 246,000 tons), worth 1.93 trillion yuan. Trading tripled by volume and grew 5-fold by value compared with 2010.

|