- Circular & News

- Market

-

Services

We collaborate with industry leading vendors, service providers and media portals to distribute real-time and delayed data at a global scale. Companies interested in becoming our market data vendor, please feel free to apply.

Become a VendorOur Members Rules and Regulations

Rules and Regulations

Rules

Supervision

Trading

Settlement

Delivery

Technology

Trading Business Floor Trader Management Account Opening Seat Management Program Trading Filing Hedging Operation TAS Market Maker DownloadMarket Data

Members and Overseas Special Participants

PFMI

-

Data

{{data.day.split('-').slice(2).join()}}

{{ currentDate.substring(0,4) + '-' + currentDate.substring(4,6) + '-' + currentDate.substring(6,8) }}No data available.Trading notice:Settlement notice:Delivery notice: - Market Insights

-

About SHFE

RISK MANAGEMENT RULES OF THE SHANGHAI FUTURES EXCHANGE

Updated on 2025-08-07RISK MANAGEMENT RULES OF THE SHANGHAI FUTURES EXCHANGE

CHAPTER 1 GENERAL PROVISIONS

Article 1 These Risk Management Rules are made, in accordance with the General Exchange Rules of the Shanghai Futures Exchange, to strengthen the risk management of futures trading, safeguard the lawful rights and interests of the futures market participants and guarantee the futures trading activities on or through the Shanghai Futures Exchange, or the Exchange.

Article 2 The risk management regimes adopted by the Exchange include the Margin Requirement, the Price Limit, the Position Limit, the Trading Limit, the Large Trader Position Reporting, the Forced Position Liquidation, and the Risk Warning, etc.

Article 3 These Risk Management Rules are binding on the Exchange, Members, Overseas Special Participants (“OSPs”), Overseas Intermediaries, and Clients.

CHAPTER 2 MARGIN REQUIREMENT

Article 4 The Exchange applies Margin Requirement.

When the following conditions occur in the process of trading a futures contract, the Exchange may, in view of market risk conditions, adjust the trading margin of a contract:

(1) the open interest reaches a certain level;

(2) the delivery period approaches;

(3) the price change of a contract amounts to a certain rate after a consecutive number of trading days;

(4) a futures contract reaches the Price Limit for consecutive trading days;

(5) a long public holiday is approaching;

(6) the Exchange, at its discretion, decides that the risk of the market is increasing; and

(7) other events or conditions the Exchange deems necessary to adjust the trading margin of a contract.

The Exchange shall make a public announcement and report to the China Securities Regulatory Commission (“CSRC”) of its decision to adjust the trading margin.

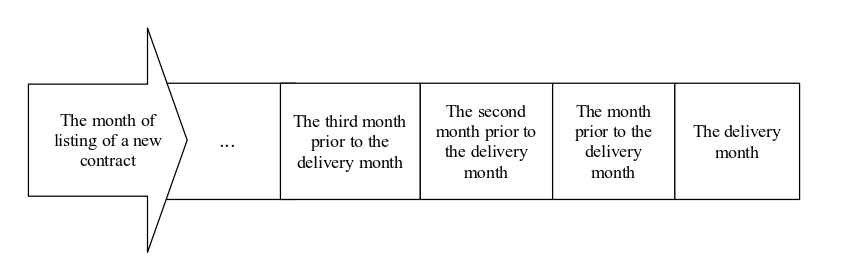

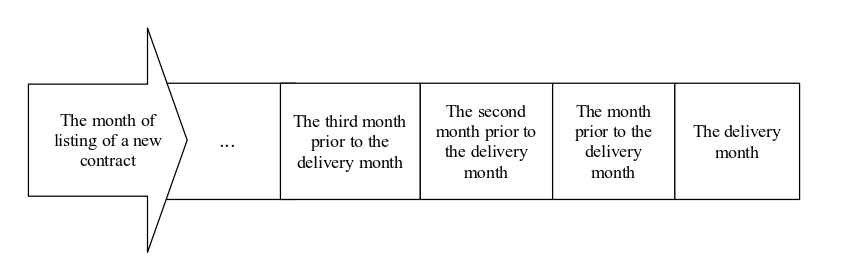

Article 5 The Exchange applies different rates of trading margin for a futures contract based on the stage of its lifecycle (i.e., from the listing day to the last trading day). Specific rates are governed by the futures rules for the particular products.

When a futures contract approaches a stage of trading that requires a trading margin adjustment, the Exchange shall, at daily clearing on the trading day prior to the day that such adjustment shall take effect, settle existing positions at the new rate of trading margin. Anyone with insufficient margin balance shall deposit additional funds to meet the Margin Requirement by market-open of the next trading day.

During the delivery month, a seller may post standard warrants as a performance security for the corresponding size of open positions in the delivery month, in which case the trading Margin Requirement for those positions will be waived.

The following is an example of the period of trading of the futures contract, Cu0305, from its listing to its last trading day:

|

Period of trading |

From May 16, 2002 to May 15, 2003 |

|

Date of listing |

May 16, 2002 |

|

Last trading day |

May 15, 2003 |

|

Trading day prior to the last trading day |

May 14, 2003 |

|

Second trading day prior to the last trading day |

May 13, 2003 |

|

Delivery month |

May 2003 |

|

Month prior to the delivery month |

April 2003 |

|

Second month prior to the delivery month |

March 2003 |

|

Third month prior to the delivery month |

February 2003 |

This paragraph exemplifies the division of time periods of a futures contract referred to in these Risk Management Rules.

Article 6 In the event that trading in a futures contract reaches a Price Limit, the Margin Requirements set forth in Chapter 3 of these Risk Management Rules shall apply.

Article 7 For a futures contract:

(a) if the price change in aggregate (denoted as N) reaches 1.5 times the normal Price Limit of the contract for three (3) consecutive trading days (denoted as D1-D3) or

(b) if the price change in aggregate (denoted as N) reaches 2 times the normal Price Limit of the contract for four (4) consecutive trading days (denoted as D1-D4) or

(c) if the price change in aggregate (denoted as N) reaches 2.5 times the normal Price Limit of the contract for five (5) consecutive trading days (denoted as D1-D5),

the Exchange may, in view of market conditions, take one or a combination of the following measures with a prior report to the CSRC:

(i) require additional trading margin from the long or short positions or both, at the same or different rates, and from some or all of the Members and/or OSPs;

(ii) limit the withdrawal of funds by some or all of the Members;

(iii) suspend the opening of new positions by some or all of the Members and/or OSPs;

(iv) adjust the Price Limit, but not to be over twenty percent (20%) up or down;

(v) order the liquidation of positions by a prescribed deadline; or

(vi) exercise Forced Position Liquidation; and/or

(vii) take other measures the Exchange deems necessary.

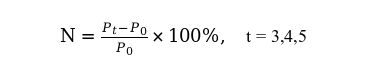

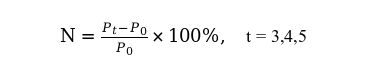

N is calculated using the following formula:

P0 is the settlement price of the trading day prior to D1;

Pt is the settlement price of the trading day “t” and t = 3, 4, 5;

P3 is the settlement price of D3;

P4 is the settlement price of D4;

P5 is the settlement price of D5.

Article 8 In the event that two or more trading margins are applicable as prescribed in this Chapter 2, the higher or the highest shall be applied as the trading margin.

Article 9 Clearing deposit is managed in accordance with the Clearing Rules of the Shanghai Futures Exchange.

CHAPTER 3 PRICE LIMIT

Article 10 The Exchange applies the Price Limit which sets the maximum price change for each futures contract during a trading day.

The Exchange will, at its sole discretion, adjust the Price Limit of a futures contract when any of the following events or conditions occurs:

(1) the same direction limit-locked market exists in the trading of a futures contract;

(2) a long public holiday is approaching;

(3) the Exchange, at its discretion, decides that the risk of the market is increasing; and

(4) other events or conditions the Exchange deems necessary to adjust the Price Limit.

The Exchange shall make a public announcement and report to the CSRC of its decision to adjust the Price Limit.

If two or more limit prices are applicable as prescribed in this Chapter 3, the higher or the highest shall be applied as the Price Limit.

Article 11 When a futures contract hits the Price Limit, trades shall be matched with priority given to the bids or the asks which facilitate the close-out of the open interest, except for new positions opened on the current day, and based on the time priority rule.

Article 12 The term “limit-locked market” means the situation in which within the five (5) minutes prior to the close of a trading day, there are only bids (asks) but no asks (bids) at the limit price, or any asks (bids) are instantly filled while the limit price still exists, with the current price equaling the limit price.

The term “same direction limit-locked market” means the situation in which the limit-locked market exists for two (2) consecutive trading days. The term “reverse direction limit-locked market” means the situation in which on the trading day following a limit-locked market, the limit-locked market goes to the opposite direction.

Article 13 In the event that a limit-locked market occurs to a futures contract on a trading day (denoted as D1 whereas the previous trading day is D0 and the successive five (5) trading days are D2-D6), the Price Limit and trading margin of the contract for D2 shall be adjusted as follows:

(1) the Price Limit shall be increased by three percent (3%) on top of that for D1; and

(2) the trading margin shall be increased by two percent (2%) on top of the Price Limit for D2. If the trading margin as adjusted is smaller than what is applied on D0 to the daily clearing, the same trading margin as applied on D0 will be used as the trading margin for that contract.

If D1 is the first trading day for a newly listed contract, the contract’s trading margin for D1 shall be used as the trading margin applied to the daily clearing of D0.

Article 14 If a limit-locked market does not occur on D2 for a futures contract set forth in Article 13 of these Risk Management Rules, the Price Limit and trading margin for D3 will return to the regular level.

The occurrence of a reverse direction limit-locked market on D2 shall trigger a new round of a limit-locked market, i.e. D2 shall become D1 for the new round of limit-locked market, and the margin rate and the Price Limit for the following trading day shall be set pursuant to the Article 13 of these Risk Management Rules.

If the same direction limit-locked market exists on D2, the Price Limit and trading margin of the contract for D3 shall be adjusted as follows:

(1) the Price Limit shall be increased by five percent (5%) on top of the Price Limit for D1; and

(2) the trading margin shall be increased by two percent (2%) on top of the Price Limit for D3. If the adjusted trading margin is smaller than what is applied on D0 to the daily clearing, the trading margin on D0 will be applied to meet the Margin Requirements for that contract.

Article 15 If a limit-locked market does not occur on D3 for a futures contract set forth in Article 13of these Risk Management Rules, the Price Limit and trading margin for D4 will return to the regular level.

The occurrence of a reverse direction limit-locked market on D3 shall trigger a new round of a limit-locked market, i.e. D3 shall be regarded as D1 for the new round of limit-locked market, and the trading margin and the Price Limit for the following trading day shall be set pursuant to the Article 13 of these Risk Management Rules.

If a same direction limit-locked market occurs on D3, which means, for three (3) consecutive trading days, the market has been locked in Price Limit, the Exchange may, at the daily clearing, suspend the withdrawal of funds by some or all of its Members and take the following measures:

(1) if D3 is the last trading day of the contract, the contract shall move into its settlement and physical delivery phase on the next trading day;

(2) if D4 is the last trading day, the Price Limit and trading margin for D3 will be extended to D4 and the contract shall move into its settlement and physical delivery phase on the next trading day; or

(3) if neither D3 nor D4 is the last trading day, the Exchange may, the Exchange may, according to market conditions, take the actions provided in Article 16 or Article 17 of these Risk Management Rules after the close of D3.

Article 16 The Exchange may, in accordance with the third paragraph (3) of Article 15 of these Risk Management Rules, make a public announcement after the close of D3 that the futures contract will be traded on D4 and take one or more of the following measures:

(1) adjust the Price Limit, but not to be over twenty percent (20%) up or down;

(2) require additional trading margin from the long or short positions or both, at the same or different rates, and from some or all of the Members and/or OSPs;

(3) suspend the opening of new positions by some or all of the Members and/or OSPs;

(4) limit the withdrawal of funds;

(5) order the liquidation of positions by a prescribed deadline;

(6) exercise Forced Position Liquidation; and/or

(7) take other actions that the Exchange deems necessary.

If the Exchange takes any of the above measures, the futures contract under Article 13 of these Risk Management Rules shall be traded on D5 as follows:

(1) if a limit-locked market does not occur on D4, the Price Limit and trading margin for D5 will return to their regular level;

(2) the occurrence of a reverse direction limit-locked market on D4 shall trigger a new round of a limit-locked market, i.e. D4 shall be regarded as D1 for the new round of limit-locked market, and the trading margin and the Price Limit for the following trading day shall be set pursuant to the Article 13 of these Risk Management Rules; and

(3) if the same direction limit-locked market occurs on D4, the Exchange may declare it as an abnormal condition and take risk management measures as provided in the applicable rules.

Article 17 The Exchange may, in accordance with the third paragraph (3) of Article 15 of these Risk Management Rules, make a public announcement after the close of D3 that the futures contract will be suspended from trading on D4, and further announce on D4 or after the close of D4 that it will take any actions under Article 18 or Article 19 of these Risk Management Rules based on market conditions.

Article 18 The Exchange may, in accordance with Article 17 of these Risk Management Rules, decide that a futures contract under Article 13 of these Risk Management Rule shall be traded on D5 and take one or more of the following actions:

(1) adjust the Price Limit, but not to be over twenty percent (20%) up or down;

(2) require additional trading margin from the long or short positions or both, at the same or different rates, and from some or all of the Members and/or OSPs;

(3) suspend the opening of new positions by some or all of the Members and/or OSPs;

(4) limit the withdrawal of funds;

(5) order the liquidation of positions by a prescribed deadline;

(6) exercise Forced Position Liquidation; and/or

(7) take other actions that the Exchange deems necessary.

If the Exchange takes any of the above measures, the futures contract under Article 13 of these Risk Management Rules shall be traded on D6 as follows:

(1) if a limit-locked market does not occur on D5, the Price Limit and trading margin for D6 will return to the regular level.

(2) the occurrence of a reverse direction limit-locked market on D5 shall trigger a new round of a limit-locked market, i.e. D5 shall be regarded as D1 for the new round of limit-locked market, and the trading margin and the Price Limit for the following trading day shall be set pursuant to the Article 13 of these Risk Management Rules; and

(3) if the same direction limit-locked market occurs on D5, the Exchange may declare it as an abnormal condition and take risk management measures as provided in the applicable rules.

Article 19 If the Exchange declares an abnormal condition and makes a forced position reduction, it shall specify the base date and the affected contracts. The base date shall be the last trading day on which a limit-locked market occurs and the forced position reduction is performed.

When performing a forced position reduction, the Exchange shall automatically match all unfilled orders that are placed by the close of the base date at the limit price with the open positions held by each Trader (referring here and hereinafter to a Client, Non-FF Member, or Overseas Special Non-Brokerage Participant (“OSNBP”)) that records gains on its net positions, on a pro rata basis at that limit price. If that Trader has both long and short positions, these positions will be matched and settled before being matched with those rest orders. The procedure is as follows:

(1) Determination of the amount of the unfilled orders subject to the order fill:

The term “amount of unfilled orders subject to the order fill” means the total amount of all the unfilled orders submitted after the close of the base date at the limit price into the central order book by each Client who has incurred losses on net positions in the contract of an average level of no less than R1 of the settlement price of the base date. The Client unwilling to be subjected to this method may cancel the orders before the close of the market on the base date, to avoid having the orders filled.

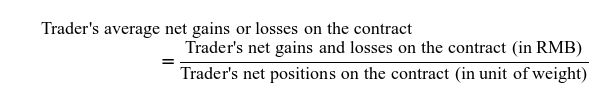

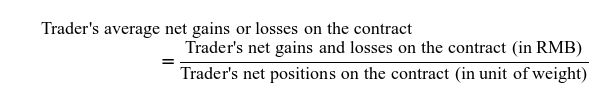

(2) Calculation of each Trader’s average gains or losses on net positions

A trader net gains or losses on the affected futures contract shall equal the sum of the differences between the daily settlement price on the current day and the actual execution price of contracts where the cumulative amount of the historical transaction positions match the amount of net positions of the current day by tracing back the historical transactions.

(3) Determination of positions eligible to fill the unfilled orders

The positions eligible to fill the unfilled orders include the net positions, on which the Trader, as calculated using the above formula, records average gains for general purposes or for hedging purposes at no less than R1 of the settlement price of the base date.

(4) Principles and methods for the order fill of unfilled orders

(a) Principles

(i) The order fill of unfilled orders shall take place in the order of the following four levels with regard to the amount of gains and whether such positions are general, hedging or otherwise:

Level 1: Unfilled orders shall be filled with the general positions eligible to fill the unfilled orders of any Trader with average gains on net positions of no less than R1;

Level 2: Unfilled orders shall be filled with the general positions eligible to fill the unfilled orders of any Trader with average gains on net positions of no less than R2 but no more than R1 of the settlement price on the base date;

Level 3: Unfilled orders shall be filled with the general positions eligible to fill the unfilled orders of a Trader with average gains on net positions of no more than R2 of the settlement price on the base date; and

Level 4: Unfilled orders shall be filled with the hedging positions eligible to fill the unfilled orders of a Trader with average gains on net positions of no less than R1 of the settlement price on the base date.

(ii) In each level, the order fill shall be made pro rata to the amount of the positions available to fill the unfilled orders, compared to the amount of the unfilled orders, or the residual unfilled orders.

(b) Methods and procedures can be found in the Appendix

If the amount of the General Positions with Gains of Over R1 is greater than or equal to that of the unfilled orders, the unfilled orders shall be filled pro rata to the amount of the General Positions with Gains of Over R1;

If the amount of the General Positions with Gains of Over R1 is smaller than that of the unfilled orders, the General Positions with Gains of Over R1 shall be filled pro rata to the amount of the unfilled orders. The residual unfilled orders, if any, shall be filled with the General Positions with Gains of Over R2 in the same manner as the foregoing, and if there are still orders remaining, the outstanding unfilled orders shall be filled to the General Positions with Gains of Below R2, and so to the Hedging Positions with Gains of Over R1. Unfilled orders which eventually remain after all the order fills described above, if any, shall not be filled at all.

(5) Decimals of the Unfilled Orders

Positions are filled to the unfilled orders posted to the central order book under each trading code. In the first step, the integral portion of the total size of unfilled orders posted under each trading code shall be filled. In the second step, the remaining unfilled portion, i.e. the portion in decimal number posted under each trading code, shall be filled according to the ranking of the trading codes from highest to lowest decimal with each trading code being filled with one (1) lot, except that if there are two or more Traders with equal decimals that could be included in the fill, such fill shall be done on a random basis if there are no enough positions to fill the orders.

If market risk is mitigated after the above measures are implemented, the Price Limit and the trading margin will return to their regular levels on the next trading day; otherwise, the Exchange shall take additional risk management measures.

Financial losses incurred as a result of the implementation of the above measures shall be borne by the Member, OSP, Overseas Intermediary and their Clients.

The specific value of parameters R1 and R2 shall be governed by the futures rules for the particular products.

Article 20 If the Exchange declares an abnormal condition pursuant to these Risk Management Rules, it may take such emergency actions as adjusting the time of market opening and closing, suspending trading, adjusting the Price Limit, raising the Margin Requirement, ordering the liquidation of positions by a prescribed deadline, exercising Forced Position Liquidation, limiting the withdrawal of funds, making forced position reduction, and restricting trading, etc.

CHAPTER 4 POSITION LIMIT

Article 21 The Exchange applies the Position Limit.

The term “Position Limit” means the maximum size of long or short positions each Member, OSP, Overseas Intermediary, or Client may hold in a futures contract as prescribed by the Exchange. A Non-FF Member, OSNBP, or Client may increase its Position Limit by applying for arbitrage position quota.

Notwithstanding the preceding paragraph, hedging position quotas shall be subject to the approval of the Exchange.

Article 22 The following fundamental rules shall govern the Position Limit:

(1) a specific Position Limit is set for each product and its futures contract, based on its particular conditions;

(2) different Position Limits are applicable to different stages of trading of a contract, and the Exchange shall exercise stringent control over the Position Limit in the delivery month of the contract;

(3) a percentage-based Position Limit is imposed on FF Members, Overseas Special Brokerage Participants (“OSBPs”) and Overseas Intermediaries in accordance with rules, and both a percentage-based and a fixed-amount Position Limit are imposed on Non-FF Members, OSNBPs, and Clients.

Article 23 For a Client with multiple trading codes opened through one or more FF Members, OSBPs, or Overseas Intermediaries, the aggregate amount of all the open positions of all the futures contracts held by the Client under each trading code shall not exceed the Client’s Position Limit prescribed by the Exchange.

By the close of the last trading day of the month prior to the delivery month, each trader shall adjust its general positions in a futures contract held under its trading code to multiples of the number of lots of the delivery unit (a one-day extension is permitted in special market conditions); in the delivery month, the general positions as well as newly opened and closed-out positions shall be held in multiples of the number of lots of the delivery unit.

The rounding of the size of hedging positions in the futures contracts enumerated in the preceding paragraphs to multiples of a certain number of lots is made by reference to the foregoing paragraph.

To the extent of any inconsistency between these Risk Management Rules and the futures rules for the particular products, the product rules shall prevail.

Article 24 Percentage-based position and fixed-amount Position Limit for each futures contract at different stages of trading for a Member, OSP, Overseas Intermediary, and Client are governed by the futures rules for the particular products.

Article 25 The Exchange may adjust the percentage-based Position Limit of an FF Member based on its operating results.

The Exchange may adjust the percentage-based Position Limit of an FF Member, to no higher than thirty-five percent (35%), according to the rating of futures firms as per the CSRC’s supervision criteria.

Conditions for the adjustment of percentage-based Position Limits of FF Members and their specific position-based Position Limits, the period for imposition of such limits, and other matters will be notified by the Exchange.

Article 26 The Exchange may, based on market conditions, adjust the Position Limits for different listed products and contracts. Any adjustment to the Position Limit shall be reported by the Exchange to the Board of Directors of the Exchange, or the Board, and the CSRC, for approval prior to its implementation.

Article 27 The size of open positions held by a Non-FF Member or OSNBP shall not exceed the size of the Position Limit set by the Exchange; otherwise, the Exchange shall exercise Forced Position Liquidation subject to the applicable rules of the Exchange.

If the open positions held in aggregate by a Client through multiple trading codes opened with different futures firm Members (“FF Members”), OSBPs, or Overseas Intermediaries exceed the Client’s Position Limit, the Exchange shall instruct the FF Members or OSBPs to exercise Forced Position Liquidation of the excess positions of that Client.

An FF Member or OSBP shall not hold positions in excess of the Position Limit prescribed by the Exchange. Upon the reach or exceedance of such Position Limit, opening new position in that direction will be prohibited. When the aggregate open positions held by an Overseas Intermediary through one or more FF Members or OSBPs reach or exceed the Position Limit prescribed by the Exchange, opening new positions on the next trading day will be prohibited.

CHAPTER 5 TRADING LIMIT

Article 28 The Exchange applies Trading Limit. The term “Trading Limit” means the maximum size of positions opened by some or all of the Members, OSPs, and Clients in a contract within a certain period in accordance with the requirements of the Exchange. The Exchange may, based on market conditions, set the maximum size of positions opened within a day in different listed products and contracts for some or all of the Members, OSPs, and Clients. The specific criteria will be determined by the Exchange.

Hedging trades are not subject to the preceding paragraph.

CHAPTER 6 LARGE TRADER POSITION REPORTING

Article 29 The Exchange applies the Large Trader Position Reporting regime. Any Member, OSP or Client whose general positions in a futures contract reaches eighty percent (80%) or more of its Position Limit specified in the Exchange’s futures rules for the particular products, or any Overseas Intermediary whose general positions in a futures contract reaches sixty percent (60%) or more of its Position Limit specified therein, or upon request by the Exchange, shall report to the Exchange about its financial conditions, open positions, delivery intention, and other information. The Exchange may set and adjust the threshold, contents, and submission method of such reports according to market risk conditions.

Article 30 Any Member, OSP, Overseas Intermediary or Client whose positions reach the reportable level shall take the initiative to submit a report to the Exchange by 15:00 of the following trading day, and shall ensure the information in the large trader position reports and other related materials are truthful, accurate, and complete. The Exchange will notify relevant individuals if submission of a new or supplementary report is deemed as necessary.

Article 31 A Member or an OSP shall submit its large trader position reports to the Exchange directly. An Overseas Intermediary shall submit such reports through the FF Member or OSBP that handle trading and clearing on its behalf.

Article 32 A Client shall submit its large trader position reports through its carrying FF Member or OSBP. A Client that engages in futures trading through an Overseas Intermediary shall request the Overseas Intermediary to submit such reports through the relevant FF Member or OSBP. If the aggregate positions held by a Client under multiple trading codes opened with different FF Members, OSBPs, and Overseas Intermediaries reaches the reporting threshold, the Client shall voluntarily submit a large trader position report through the relevant FF Member, OSBP, or Overseas Intermediary. If the said Client fails to file a report with the Exchange, its carrying FF Member, OSBP, or Overseas Intermediary shall do so on its behalf. The Exchange may also designate and notify the relevant FF Member, OSBP, or Overseas Intermediary to submit the report.

Article 33 The FF Member, OSBP or Overseas Intermediary, whose positions meet the position reportable level, shall provide to the Exchange the following documents:

(1) a completed large trader position reporting form;

(2) a description of the source of funds;

(3) names, trading codes, respective open positions, account opening documents and daily settlement statements of its top five (5) Clients ranking in terms of size of open positions; and

(4) any other documents as required by the Exchange.

Article 34 The Non-FF Member or OSNBP, whose positions reach the reportable level, shall provide to the Exchange the following documents:

(1) a completed large trader position reporting form;

(2) a description of the source of funds; and

(3) any other documents as required by the Exchange.

Article 35 Any Client, whose positions reach the reportable level shall provide to the Exchange the following documents:

(1) a completed large trader position reporting form;

(2) an explanation of the source of its funds;

(3) account opening documents and the settlement statement of the current day; and

(4) any other documentation required by the Exchange.

Article 36 Each FF Member, OSBP, or Overseas Intermediary shall review the documents submitted by its Client whose positions reach the reportable level and ensure they are truthful and accurate before forwarding them to the Exchange. The FF Member, OSBP or Overseas Intermediary shall properly keep original copies signed by the Client or the Client’s telephone recordings and other supporting documents in relation to the Large Trader Position Reporting.

Article 37 The Exchange may, in view of market risk conditions, require specific Members, OSPs, Overseas Intermediaries, or Clients to submit large trader position reports or other explanatory materials, and may verify these documents from time to time.

CHAPTER 7 FORCED POSITION LIQUIDATION

Article 38 The Exchange applies Forced Position Liquidation to manage market risks. The term “Forced Position Liquidation” means the mandatory action the Exchange takes to close out the positions of a Member, OSP, Overseas Intermediary, or Client who violates any applicable rules of the Exchange.

Article 39 The Exchange shall impose Forced Position Liquidation, if:

(1) the clearing deposit balance of a Member recorded on any internal ledger at the Exchange, whether for its own account or for one it provides clearing services to, falls below zero (0) and it fails to meet the Margin Requirement within the specified time limit;

(2) the open positions of a Non-FF Member, OSNBP, or Client exceed the size of the applicable Position Limit;

(3) such Member or Client fails to bring its positions in a futures contract to multiples as required within the specified time limit;

(4) such Member or Client violates any Exchange’s rules that warrants a Forced Position Liquidation;

(5) any emergency occurs that warrants a Forced Position Liquidation; or

(6) any other conditions exist that makes the Forced Position Liquidation necessary.

Article 40 Principles

The Member or OSP shall, in the first place, exercise Forced Position Liquidation as required by the Exchange by the end of the first trading session on the current trading day or within the time limit prescribed by the Exchange. If the Member or OSP fails to fulfill the execution within the defined time limit, the Forced Position Liquidation shall be enforced by the Exchange. If Forced Position Liquidation is required because of a negative clearing deposit balance on an internal ledger of the Exchange, then before the Margin Requirement is met, the Member, Overseas Intermediary, or Client that corresponds to the internal ledger, or the OSP, Overseas Intermediary, or Client that corresponds to the internal ledger through which it receives clearing services, shall be prohibited from opening new positions.

(1) Positions for the Member’s Execution of Forced Position Liquidation

(a) Under the conditions provided in the Article 39 (1) and (2), the Member shall determine the portion of positions that could be included in the scope of Forced Position Liquidation at its discretion to achieve the results required by the Exchange’s applicable rules.

(b) Under the conditions provided in the Article 39 (3)-(6), the Exchange shall determine the portion of positions that could be included in the scope of Forced Position Liquidation.

(2) Positions for the Exchange’s Execution of Forced Position Liquidation

(a) Under the conditions provided in the Article 39 (1), the Exchange shall liquidate the positions subject to the priority of general positions over hedging positions, futures over options, and in a descending sequence by the size of the open interest for each contract at the close of the previous trading day, i.e., the contract with the largest open interest shall be liquidated first; and proceed to the liquidation on positions based on the Client’s losses on net positions in a descending sequence.

Where more than one Member is required to have its open positions liquidated, priority shall be given to the Members with the greatest margin call according to the ranking of margin calls in a descending sequence.

(b) Under the conditions provided in the Article 39 (2), the Exchange shall take the following measures:

If the positions of a Non-FF Member, OSNBP, or Client exceed the Position Limit, the portion in excess shall be liquidated.

If the positions of an FF Member, OSBP, Overseas Intermediary, or Client exceed the applicable Position Limits simultaneously, the excess positions of the Client shall be liquidated first, followed by the excess positions of the FF Member, OSBP, and Overseas Intermediary in accordance with the rules applicable to them.

(c) Under the conditions provided in the Article 39 (3)- 39 (6), the Exchange shall, as appropriate for the circumstances, determine the portion of open positions of each involving Member, OSP, Overseas Intermediary, and Client for Forced Position Liquidation.

If a Member simultaneously meets the conditions as provided in Article 39 (1) and 39 (2), the Exchange shall determine the positions for Forced Position Liquidation pursuant to the Article 39 (2) in the first place, and then pursuant to the Article 39 (1).

Article 41 Enforcement of Forced Position Liquidation

(1) Notification.

The Exchange shall issue a notice of Forced Position Liquidation, or the notice, to the Member who is subject to the Forced Position Liquidation. In addition, the notice shall be delivered to the Member through the Member service system along with the daily clearing data. For OSPs, the notice of Forced Position Liquidation is sent to the Members who clear trades on their behalf, upon which the Members shall promptly notify the OSPs.

(2) Enforcement and Confirmation

(a) After the market opens, the Member or OSP covered by the notice shall enforce the liquidation of its positions and reduce the size of its open positions to the prescribed level, which will be subject to the Exchange’s verification;

If the Member or OSP is subject to the situation provided in the Article 39 (3), the Exchange may directly enforce liquidation in respect of the open positions held by such Member;

(b) If the Member or OSP fails to complete the Forced Position Liquidation within the specified time limit, the Exchange will directly enforce liquidation of the remaining open positions;

(c) Upon the conclusion of the Forced Position Liquidation, the Exchange shall record the enforcement results for filing purpose; and

(d) The enforcement results of the Forced Position Liquidation shall be delivered along with the daily trade records.

Article 42 Liquidation shall be enforced at a price formed through trades executed on the market.

Article 43 If the Forced Position Liquidation fails to be completed within the specified time due to the limit price or as the result of other market conditions, the remainder of positions subject to the Forced Position Liquidation may and will be closed out on the next trading day pursuant to the principles described in Article 40.

Article 44 If the Forced Position Liquidation fails to be completed for the current day due to the limit price or as the result of other market conditions, the Exchange shall take measures as appropriate, with regard to the daily clearing status of the Member or OSP, to resolve any consequences that may derive from the incomplete Forced Position Liquidation.

Article 45 If the enforcement of the Forced Position Liquidation on the specific positions must be prolonged due to the Price Limit or as the result of other market conditions, any losses incurred as such shall be borne by the person directly accountable for the enforcement of liquidation. In the event of failure to complete the enforcement of liquidation, the holder of the open positions subject to the Forced Position Liquidation shall assume all the responsibilities arising from its ownership and bears all the obligations of delivery on the covered contracts.

Article 46 Gains, if any, arising from a Forced Position Liquidation executed by a Member or OSP, shall be credited to the person directly accountable for the enforcement of liquidation; gains arising from the Exchange’s enforcement of liquidation shall be disposed of in compliance with the national regulations. Losses arising from a Forced Position Liquidation shall be borne by the person directly accountable for the enforcement of liquidation.

If the person directly accountable for the liquidation is a Client, any losses arising from the Forced Position Liquidation shall first be borne by its carrying Member, after which the Member may recover the amount from the relevant OSBP, Overseas Intermediary, or Client through legal proceedings. If the person directly accountable for the liquidation is an OSBP or Overseas Intermediary, any losses arising from the Forced Position Liquidation shall first be borne by its carrying Member, after which the Member may recover the amount from the OSBP or Overseas Intermediary through legal proceedings.

CHAPTER 8 MANAGEMENT OF ABNORMAL CONDITIONS

Article 47 The Exchange may take emergency actions to mitigate risks and announce an abnormal condition, if during futures trading,

(1) transactions, settlement, delivery, options contracts’ exercise and fulfillment, or other businesses cannot be conducted as normal due to such reasons as earthquake, flood, fire, and other force majeure events, or computer system breakdown;

(2) any failure to fulfill the obligations of settlement, delivery, or options contracts’ exercise and fulfillment is having or is expected to have serious impact on the market;

(3) the same direction limit-locked market exists in the trading of a futures contract, and it is justified to believe that any Member, OSP, Overseas Intermediary, or Client has violated the General Exchange Rules of the Shanghai Futures Exchange or other applicable rules of the Exchange, which is having or is expected to have material impact on the market; or

(4) there occur other circumstances as prescribed by the Exchange.

When an abnormal condition stated in sub-paragraph (1) of the first paragraph occurs, the Exchange’s Chief Executive Officer (CEO) may determine to adjust the time for market opening and closing; temporarily suspend trading; adjust the trading hours; temporarily suspend the listing of new contracts; adjust the last trading day, expiry date, delivery period, physical delivery date, among others, of the relevant contracts; adjust businesses related to standard warrants and delivery, to the exercise, fulfillment, and offsetting of relevant options contracts, or to the use of assets as margin, and cancel any pending applications for such businesses; adjust the implementation time of Forced Position Liquidation, the collection standards or methods of margin, and Price Limit; adjust the settlement price and final settlement price of relevant contracts; adjust the collection standards and payment period of relevant fees; adjust the ways for sending clearing data; or take any other emergency actions. When an abnormal condition stated in sub-paragraph (1) of the first paragraph occurs, and any trading order or execution data is corrupted or lost and cannot be restored, the CEO may determine to cancel any unfulfilled trading orders, and the Board of Directors may determine to cancel any transactions.

When an abnormal condition stated in sub-paragraphs (2) to (4) of the first paragraph occurs, the Board of Directors may determine to adjust the time for market opening and closing, temporarily suspend trading, adjust the Price Limit, raise the Margin Requirement, order the liquidation of positions by a prescribed deadline, exercise Forced Position Liquidation, limit the withdrawal of funds, make forced position reduction, restrict transactions, or take any other emergency actions.

Article 48 The Exchange shall report to the CSRC before announcing abnormal conditions and taking any emergency actions.

Article 49 Where the Exchange announces an abnormal condition and decides to temporarily suspend trading, the suspension shall be no longer than three (3) trading days, unless otherwise approved by the CSRC.

CHAPTER 9 RISK WARNING

Article 50 The Exchange may, as it deems necessary, resort to the following measures, alone or in combination, to warn against and resolve risks:

(1) request an explanation with respect to a specific situation;

(2) arrange a meeting to give an oral warning;

(3) issue a written warning;

(4) give a public censure; or

(5) issue a Risk Warning.

Article 51 The Exchange may require a situational report from the relevant Member, OSP, Overseas Intermediary, or Client, or require a meeting with the Client or the designated senior manager of the Member, OSP, or Overseas Intermediary to call attention to the relevant risks, when any of the following circumstances arises:

(1) unusual futures or options price movements;

(2) unusual trading activities by such Member, OSP, Overseas Intermediary, or Client;

(3) any irregularity in the open positions of such Member, OSP, Overseas Intermediary, or Client;

(4) any irregularity in such Member’s funds on deposit;

(5) any suspected violation or default by such Member, OSP, Overseas Intermediary, or Client;

(6) any allegation, accusation or complaint against such Member, OSP, Overseas Intermediary, or Client received by the Exchange;

(7) any judicial investigation against such Member, OSP, Overseas Intermediary, or Client; or

(8) other conditions as the Exchange deems necessary.

The following rules shall be observed in a reminder meeting:

(1) A meeting arranged by the Exchange to call attention to the relevant risks shall take place in such formats as an in-person meeting or a video conference;

(2) Where the Exchange requires a Member, OSP, Overseas Intermediary, or Client to attend a reminder meeting, it shall notify the relevant Member, OSP, or Overseas Intermediary of the time, location, and requirements of the meeting in writing and in advance;

(3) The Member, OSP, or Overseas Intermediary shall arrange the relevant manager to attend the reminder meeting in accordance with the requirements of the written notice. A Client required to attend a meeting shall be accompanied by the designated individual of its carrying Member, OSP, or Overseas Intermediary;

(4) any meeting attendee who is unable to attend the meeting due to any particular reason shall notify the Exchange in advance; with the Exchange’s approval, the party may designate a proxy to attend and act on his behalf;

(5) a meeting attendee shall make true representations and refrain from concealment of any fact; and

(6) the Exchange’s employees shall maintain the confidentiality of any information related to the meeting.

The Member, OSP, Overseas Intermediary, or Client may refer to the regime of the Large Trader Position Reporting for manner and contents of the report, if it or he is ordered by the Exchange to provide an explanation with respect to a specific situation.

Article 52 The Exchange may issue a Risk Warning letter to the Member, OSP, Overseas Intermediary, or Client, if it finds that such Member, OSP, Overseas Intermediary, or Client commits any suspected violation of the Exchange’s rules or holds position that is exposed to substantial potential risks.

Article 53 The Exchange will publicly censure a Member, OSP, Overseas Intermediary, or Client through the relevant media channels, if the Member, OSP, Overseas Intermediary, or Client commits any of the following acts:

(1) failing to provide an explanation with respect to a specific situation or attend the meeting as required by the Exchange;

(2) concealing facts, or hides, falsifies, or omits important information when explaining a specific situation or answering questions;

(3) destroying or eliminates evidence of suspected rule violations or fails to cooperate with the CSRC or the Exchange in any investigation;

(4) found to have engaged in fraudulent actions towards clients;

(5) proved, upon investigation, to trade secretly through multiple accounts or manipulate the market; or

(6) committing any other violation of the Exchange’s rules as determined by the Exchange.

Apart from publicly censuring the Member, OSP, Overseas Intermediary, or Client, the Exchange may handle its above violation pursuant to relevant provisions of the Enforcement Rules of the Shanghai Futures Exchange.

Article 54 The Exchange shall issue a Risk Warning notice to all the Members and Clients if any of the following conditions exists:

(1) unusual futures or options price movements;

(2) a considerable discrepancy between the prices of the futures and the physicals;

(3) a considerable discrepancy between prices of domestic and international futures markets; or

(4) any other abnormal conditions under which the Exchange deems he necessary to issue a Risk Warning notice.

CHAPTER 10 MISCELLANEOUS

Article 55 To the extent of any inconsistency between these Risk Management Rules and the futures rules for the particular products, the product rules shall prevail.

Article 56 If the Exchange has established any special provisions on the risk management of options trading, those provisions shall prevail.

Article 57 Any violation of these Risk Management Rules will be handled by the Exchange in accordance with these Risk Management Rules and the Enforcement Rules of the Shanghai Futures Exchange.

Article 58 The Exchange reserves the right to interpret these Risk Management Rules.

Article 59 These Risk Management Rules take effect on August 8, 2025.

Schedule—Methods and Procedures for the Fill of Unfilled Orders

Methods and Procedures for the Fill of Unfilled Orders in Futures Contracts

|

Step |

Scenario |

Amount |

Percentage |

Filled to |

Result |

|

1 |

General Positions with Gains of No Less Than R1 ≥ Unfilled Orders |

Unfilled Orders |

Unfilled Orders / General Positions with Gains of No Less Than R1 |

Traders holding the General Positions with Gains of No Less Than R1 |

Fill completed |

|

2 |

General Positions with Gains of No Less Than R1< Unfilled Orders |

General Positions with Gains of No Less Than R1 |

General Positions with Gains of No Less Than R1 / Unfilled Orders |

Traders placing the Unfilled Orders |

Residual Unfilled Orders, if any, to be filled in the Step 3, and the Step 4 |

|

3 |

General Positions with Gains of No Less Than R2 ≥ Residual Unfilled Orders I |

Residual Unfilled Orders I |

Residual Unfilled Orders I / General Positions with Gains of No Less Than R2 |

Traders holding the General Positions with Gains of No Less Than R2 |

Fill completed |

|

4 |

General Positions with Gains No Less Than R2< Residual Unfilled Orders I |

General Positions with Gains of No Less Than R2 |

General Positions with Gains of No Less Than R2 / Residual Unfilled Orders I |

Traders placing the Residual Unfilled Orders |

Residual Unfilled Orders, if any, to be filled in the Step 5, and the Step 6 |

|

5 |

General Positions with Gains of Less Than R2 ≥ Residual Unfilled Orders II |

Residual Unfilled Orders II |

Residual Unfilled Orders II / General Positions with Gains of Less Than R2 |

Traders holding the General Positions with Gains of Less Than R2 |

Fill completed |

|

6 |

General Positions with Gains of Less Than R2 < Residual Unfilled Orders II |

General Positions with Gains of Less Than R2 |

General Positions With Gains of Less Than R2 / Residual Unfilled Orders II |

Traders placing the Residual Unfilled Orders |

Residual Unfilled Orders, if any, to be filled in the Step 7, and the Step 8 |

|

7 |

Hedging Positions with Gains of No Less Than R1 ≥ Residual Unfilled Orders III |

Residual Unfilled Orders III |

Residual Unfilled Orders III / Hedging Positions with Gains of No Less Than R1 |

Traders holding the Hedging Positions with Gains of No Less Than R1 |

Fill completed |

|

8 |

Hedging Positions with Gains of No Less Than R1 < Residual Unfilled Orders III |

Hedging Positions with Gains of No Less Than R1 |

Hedging Positions with Gains of No Less Than R1 / Residual Unfilled Orders III |

Traders placing the Residual Unfilled Orders |

Orders not to be filled at all |

Notes:

1. Residual Unfilled Orders I = Unfilled Orders –General Positions with Gains of No Less Than R1;

2. Residual Unfilled Orders II = Residual Unfilled Orders I –General Positions with Gains of No Less Than R2;

3. Residual Unfilled Orders III = Residual Unfilled Orders II –General Positions with Gains of Less Than R2;

4. The General Positions or the Hedging Positions refer to open positions of the Traders who have incurred gains on positions eligible to fill the unfilled orders.

RISK MANAGEMENT RULES OF THE SHANGHAI FUTURES EXCHANGE

RISK MANAGEMENT RULES OF THE SHANGHAI FUTURES EXCHANGE

CHAPTER 1 GENERAL PROVISIONS

Article 1 These Risk Management Rules are made, in accordance with the General Exchange Rules of the Shanghai Futures Exchange, to strengthen the risk management of futures trading, safeguard the lawful rights and interests of the futures market participants and guarantee the futures trading activities on or through the Shanghai Futures Exchange, or the Exchange.

Article 2 The risk management regimes adopted by the Exchange include the Margin Requirement, the Price Limit, the Position Limit, the Trading Limit, the Large Trader Position Reporting, the Forced Position Liquidation, and the Risk Warning, etc.

Article 3 These Risk Management Rules are binding on the Exchange, Members, Overseas Special Participants (“OSPs”), Overseas Intermediaries, and Clients.

CHAPTER 2 MARGIN REQUIREMENT

Article 4 The Exchange applies Margin Requirement.

When the following conditions occur in the process of trading a futures contract, the Exchange may, in view of market risk conditions, adjust the trading margin of a contract:

(1) the open interest reaches a certain level;

(2) the delivery period approaches;

(3) the price change of a contract amounts to a certain rate after a consecutive number of trading days;

(4) a futures contract reaches the Price Limit for consecutive trading days;

(5) a long public holiday is approaching;

(6) the Exchange, at its discretion, decides that the risk of the market is increasing; and

(7) other events or conditions the Exchange deems necessary to adjust the trading margin of a contract.

The Exchange shall make a public announcement and report to the China Securities Regulatory Commission (“CSRC”) of its decision to adjust the trading margin.

Article 5 The Exchange applies different rates of trading margin for a futures contract based on the stage of its lifecycle (i.e., from the listing day to the last trading day). Specific rates are governed by the futures rules for the particular products.

When a futures contract approaches a stage of trading that requires a trading margin adjustment, the Exchange shall, at daily clearing on the trading day prior to the day that such adjustment shall take effect, settle existing positions at the new rate of trading margin. Anyone with insufficient margin balance shall deposit additional funds to meet the Margin Requirement by market-open of the next trading day.

During the delivery month, a seller may post standard warrants as a performance security for the corresponding size of open positions in the delivery month, in which case the trading Margin Requirement for those positions will be waived.

The following is an example of the period of trading of the futures contract, Cu0305, from its listing to its last trading day:

|

Period of trading |

From May 16, 2002 to May 15, 2003 |

|

Date of listing |

May 16, 2002 |

|

Last trading day |

May 15, 2003 |

|

Trading day prior to the last trading day |

May 14, 2003 |

|

Second trading day prior to the last trading day |

May 13, 2003 |

|

Delivery month |

May 2003 |

|

Month prior to the delivery month |

April 2003 |

|

Second month prior to the delivery month |

March 2003 |

|

Third month prior to the delivery month |

February 2003 |

This paragraph exemplifies the division of time periods of a futures contract referred to in these Risk Management Rules.

Article 6 In the event that trading in a futures contract reaches a Price Limit, the Margin Requirements set forth in Chapter 3 of these Risk Management Rules shall apply.

Article 7 For a futures contract:

(a) if the price change in aggregate (denoted as N) reaches 1.5 times the normal Price Limit of the contract for three (3) consecutive trading days (denoted as D1-D3) or

(b) if the price change in aggregate (denoted as N) reaches 2 times the normal Price Limit of the contract for four (4) consecutive trading days (denoted as D1-D4) or

(c) if the price change in aggregate (denoted as N) reaches 2.5 times the normal Price Limit of the contract for five (5) consecutive trading days (denoted as D1-D5),

the Exchange may, in view of market conditions, take one or a combination of the following measures with a prior report to the CSRC:

(i) require additional trading margin from the long or short positions or both, at the same or different rates, and from some or all of the Members and/or OSPs;

(ii) limit the withdrawal of funds by some or all of the Members;

(iii) suspend the opening of new positions by some or all of the Members and/or OSPs;

(iv) adjust the Price Limit, but not to be over twenty percent (20%) up or down;

(v) order the liquidation of positions by a prescribed deadline; or

(vi) exercise Forced Position Liquidation; and/or

(vii) take other measures the Exchange deems necessary.

N is calculated using the following formula:

P0 is the settlement price of the trading day prior to D1;

Pt is the settlement price of the trading day “t” and t = 3, 4, 5;

P3 is the settlement price of D3;

P4 is the settlement price of D4;

P5 is the settlement price of D5.

Article 8 In the event that two or more trading margins are applicable as prescribed in this Chapter 2, the higher or the highest shall be applied as the trading margin.

Article 9 Clearing deposit is managed in accordance with the Clearing Rules of the Shanghai Futures Exchange.

CHAPTER 3 PRICE LIMIT

Article 10 The Exchange applies the Price Limit which sets the maximum price change for each futures contract during a trading day.

The Exchange will, at its sole discretion, adjust the Price Limit of a futures contract when any of the following events or conditions occurs:

(1) the same direction limit-locked market exists in the trading of a futures contract;

(2) a long public holiday is approaching;

(3) the Exchange, at its discretion, decides that the risk of the market is increasing; and

(4) other events or conditions the Exchange deems necessary to adjust the Price Limit.

The Exchange shall make a public announcement and report to the CSRC of its decision to adjust the Price Limit.

If two or more limit prices are applicable as prescribed in this Chapter 3, the higher or the highest shall be applied as the Price Limit.

Article 11 When a futures contract hits the Price Limit, trades shall be matched with priority given to the bids or the asks which facilitate the close-out of the open interest, except for new positions opened on the current day, and based on the time priority rule.

Article 12 The term “limit-locked market” means the situation in which within the five (5) minutes prior to the close of a trading day, there are only bids (asks) but no asks (bids) at the limit price, or any asks (bids) are instantly filled while the limit price still exists, with the current price equaling the limit price.

The term “same direction limit-locked market” means the situation in which the limit-locked market exists for two (2) consecutive trading days. The term “reverse direction limit-locked market” means the situation in which on the trading day following a limit-locked market, the limit-locked market goes to the opposite direction.

Article 13 In the event that a limit-locked market occurs to a futures contract on a trading day (denoted as D1 whereas the previous trading day is D0 and the successive five (5) trading days are D2-D6), the Price Limit and trading margin of the contract for D2 shall be adjusted as follows:

(1) the Price Limit shall be increased by three percent (3%) on top of that for D1; and

(2) the trading margin shall be increased by two percent (2%) on top of the Price Limit for D2. If the trading margin as adjusted is smaller than what is applied on D0 to the daily clearing, the same trading margin as applied on D0 will be used as the trading margin for that contract.

If D1 is the first trading day for a newly listed contract, the contract’s trading margin for D1 shall be used as the trading margin applied to the daily clearing of D0.

Article 14 If a limit-locked market does not occur on D2 for a futures contract set forth in Article 13 of these Risk Management Rules, the Price Limit and trading margin for D3 will return to the regular level.

The occurrence of a reverse direction limit-locked market on D2 shall trigger a new round of a limit-locked market, i.e. D2 shall become D1 for the new round of limit-locked market, and the margin rate and the Price Limit for the following trading day shall be set pursuant to the Article 13 of these Risk Management Rules.

If the same direction limit-locked market exists on D2, the Price Limit and trading margin of the contract for D3 shall be adjusted as follows:

(1) the Price Limit shall be increased by five percent (5%) on top of the Price Limit for D1; and

(2) the trading margin shall be increased by two percent (2%) on top of the Price Limit for D3. If the adjusted trading margin is smaller than what is applied on D0 to the daily clearing, the trading margin on D0 will be applied to meet the Margin Requirements for that contract.

Article 15 If a limit-locked market does not occur on D3 for a futures contract set forth in Article 13of these Risk Management Rules, the Price Limit and trading margin for D4 will return to the regular level.

The occurrence of a reverse direction limit-locked market on D3 shall trigger a new round of a limit-locked market, i.e. D3 shall be regarded as D1 for the new round of limit-locked market, and the trading margin and the Price Limit for the following trading day shall be set pursuant to the Article 13 of these Risk Management Rules.

If a same direction limit-locked market occurs on D3, which means, for three (3) consecutive trading days, the market has been locked in Price Limit, the Exchange may, at the daily clearing, suspend the withdrawal of funds by some or all of its Members and take the following measures:

(1) if D3 is the last trading day of the contract, the contract shall move into its settlement and physical delivery phase on the next trading day;

(2) if D4 is the last trading day, the Price Limit and trading margin for D3 will be extended to D4 and the contract shall move into its settlement and physical delivery phase on the next trading day; or

(3) if neither D3 nor D4 is the last trading day, the Exchange may, the Exchange may, according to market conditions, take the actions provided in Article 16 or Article 17 of these Risk Management Rules after the close of D3.

Article 16 The Exchange may, in accordance with the third paragraph (3) of Article 15 of these Risk Management Rules, make a public announcement after the close of D3 that the futures contract will be traded on D4 and take one or more of the following measures:

(1) adjust the Price Limit, but not to be over twenty percent (20%) up or down;

(2) require additional trading margin from the long or short positions or both, at the same or different rates, and from some or all of the Members and/or OSPs;

(3) suspend the opening of new positions by some or all of the Members and/or OSPs;

(4) limit the withdrawal of funds;

(5) order the liquidation of positions by a prescribed deadline;

(6) exercise Forced Position Liquidation; and/or

(7) take other actions that the Exchange deems necessary.

If the Exchange takes any of the above measures, the futures contract under Article 13 of these Risk Management Rules shall be traded on D5 as follows:

(1) if a limit-locked market does not occur on D4, the Price Limit and trading margin for D5 will return to their regular level;

(2) the occurrence of a reverse direction limit-locked market on D4 shall trigger a new round of a limit-locked market, i.e. D4 shall be regarded as D1 for the new round of limit-locked market, and the trading margin and the Price Limit for the following trading day shall be set pursuant to the Article 13 of these Risk Management Rules; and

(3) if the same direction limit-locked market occurs on D4, the Exchange may declare it as an abnormal condition and take risk management measures as provided in the applicable rules.

Article 17 The Exchange may, in accordance with the third paragraph (3) of Article 15 of these Risk Management Rules, make a public announcement after the close of D3 that the futures contract will be suspended from trading on D4, and further announce on D4 or after the close of D4 that it will take any actions under Article 18 or Article 19 of these Risk Management Rules based on market conditions.

Article 18 The Exchange may, in accordance with Article 17 of these Risk Management Rules, decide that a futures contract under Article 13 of these Risk Management Rule shall be traded on D5 and take one or more of the following actions:

(1) adjust the Price Limit, but not to be over twenty percent (20%) up or down;

(2) require additional trading margin from the long or short positions or both, at the same or different rates, and from some or all of the Members and/or OSPs;

(3) suspend the opening of new positions by some or all of the Members and/or OSPs;

(4) limit the withdrawal of funds;

(5) order the liquidation of positions by a prescribed deadline;

(6) exercise Forced Position Liquidation; and/or

(7) take other actions that the Exchange deems necessary.

If the Exchange takes any of the above measures, the futures contract under Article 13 of these Risk Management Rules shall be traded on D6 as follows:

(1) if a limit-locked market does not occur on D5, the Price Limit and trading margin for D6 will return to the regular level.

(2) the occurrence of a reverse direction limit-locked market on D5 shall trigger a new round of a limit-locked market, i.e. D5 shall be regarded as D1 for the new round of limit-locked market, and the trading margin and the Price Limit for the following trading day shall be set pursuant to the Article 13 of these Risk Management Rules; and

(3) if the same direction limit-locked market occurs on D5, the Exchange may declare it as an abnormal condition and take risk management measures as provided in the applicable rules.

Article 19 If the Exchange declares an abnormal condition and makes a forced position reduction, it shall specify the base date and the affected contracts. The base date shall be the last trading day on which a limit-locked market occurs and the forced position reduction is performed.

When performing a forced position reduction, the Exchange shall automatically match all unfilled orders that are placed by the close of the base date at the limit price with the open positions held by each Trader (referring here and hereinafter to a Client, Non-FF Member, or Overseas Special Non-Brokerage Participant (“OSNBP”)) that records gains on its net positions, on a pro rata basis at that limit price. If that Trader has both long and short positions, these positions will be matched and settled before being matched with those rest orders. The procedure is as follows:

(1) Determination of the amount of the unfilled orders subject to the order fill:

The term “amount of unfilled orders subject to the order fill” means the total amount of all the unfilled orders submitted after the close of the base date at the limit price into the central order book by each Client who has incurred losses on net positions in the contract of an average level of no less than R1 of the settlement price of the base date. The Client unwilling to be subjected to this method may cancel the orders before the close of the market on the base date, to avoid having the orders filled.

(2) Calculation of each Trader’s average gains or losses on net positions

A trader net gains or losses on the affected futures contract shall equal the sum of the differences between the daily settlement price on the current day and the actual execution price of contracts where the cumulative amount of the historical transaction positions match the amount of net positions of the current day by tracing back the historical transactions.

(3) Determination of positions eligible to fill the unfilled orders

The positions eligible to fill the unfilled orders include the net positions, on which the Trader, as calculated using the above formula, records average gains for general purposes or for hedging purposes at no less than R1 of the settlement price of the base date.

(4) Principles and methods for the order fill of unfilled orders

(a) Principles

(i) The order fill of unfilled orders shall take place in the order of the following four levels with regard to the amount of gains and whether such positions are general, hedging or otherwise:

Level 1: Unfilled orders shall be filled with the general positions eligible to fill the unfilled orders of any Trader with average gains on net positions of no less than R1;

Level 2: Unfilled orders shall be filled with the general positions eligible to fill the unfilled orders of any Trader with average gains on net positions of no less than R2 but no more than R1 of the settlement price on the base date;

Level 3: Unfilled orders shall be filled with the general positions eligible to fill the unfilled orders of a Trader with average gains on net positions of no more than R2 of the settlement price on the base date; and

Level 4: Unfilled orders shall be filled with the hedging positions eligible to fill the unfilled orders of a Trader with average gains on net positions of no less than R1 of the settlement price on the base date.

(ii) In each level, the order fill shall be made pro rata to the amount of the positions available to fill the unfilled orders, compared to the amount of the unfilled orders, or the residual unfilled orders.

(b) Methods and procedures can be found in the Appendix

If the amount of the General Positions with Gains of Over R1 is greater than or equal to that of the unfilled orders, the unfilled orders shall be filled pro rata to the amount of the General Positions with Gains of Over R1;

If the amount of the General Positions with Gains of Over R1 is smaller than that of the unfilled orders, the General Positions with Gains of Over R1 shall be filled pro rata to the amount of the unfilled orders. The residual unfilled orders, if any, shall be filled with the General Positions with Gains of Over R2 in the same manner as the foregoing, and if there are still orders remaining, the outstanding unfilled orders shall be filled to the General Positions with Gains of Below R2, and so to the Hedging Positions with Gains of Over R1. Unfilled orders which eventually remain after all the order fills described above, if any, shall not be filled at all.

(5) Decimals of the Unfilled Orders

Positions are filled to the unfilled orders posted to the central order book under each trading code. In the first step, the integral portion of the total size of unfilled orders posted under each trading code shall be filled. In the second step, the remaining unfilled portion, i.e. the portion in decimal number posted under each trading code, shall be filled according to the ranking of the trading codes from highest to lowest decimal with each trading code being filled with one (1) lot, except that if there are two or more Traders with equal decimals that could be included in the fill, such fill shall be done on a random basis if there are no enough positions to fill the orders.

If market risk is mitigated after the above measures are implemented, the Price Limit and the trading margin will return to their regular levels on the next trading day; otherwise, the Exchange shall take additional risk management measures.

Financial losses incurred as a result of the implementation of the above measures shall be borne by the Member, OSP, Overseas Intermediary and their Clients.

The specific value of parameters R1 and R2 shall be governed by the futures rules for the particular products.

Article 20 If the Exchange declares an abnormal condition pursuant to these Risk Management Rules, it may take such emergency actions as adjusting the time of market opening and closing, suspending trading, adjusting the Price Limit, raising the Margin Requirement, ordering the liquidation of positions by a prescribed deadline, exercising Forced Position Liquidation, limiting the withdrawal of funds, making forced position reduction, and restricting trading, etc.

CHAPTER 4 POSITION LIMIT

Article 21 The Exchange applies the Position Limit.

The term “Position Limit” means the maximum size of long or short positions each Member, OSP, Overseas Intermediary, or Client may hold in a futures contract as prescribed by the Exchange. A Non-FF Member, OSNBP, or Client may increase its Position Limit by applying for arbitrage position quota.

Notwithstanding the preceding paragraph, hedging position quotas shall be subject to the approval of the Exchange.

Article 22 The following fundamental rules shall govern the Position Limit:

(1) a specific Position Limit is set for each product and its futures contract, based on its particular conditions;

(2) different Position Limits are applicable to different stages of trading of a contract, and the Exchange shall exercise stringent control over the Position Limit in the delivery month of the contract;

(3) a percentage-based Position Limit is imposed on FF Members, Overseas Special Brokerage Participants (“OSBPs”) and Overseas Intermediaries in accordance with rules, and both a percentage-based and a fixed-amount Position Limit are imposed on Non-FF Members, OSNBPs, and Clients.

Article 23 For a Client with multiple trading codes opened through one or more FF Members, OSBPs, or Overseas Intermediaries, the aggregate amount of all the open positions of all the futures contracts held by the Client under each trading code shall not exceed the Client’s Position Limit prescribed by the Exchange.

By the close of the last trading day of the month prior to the delivery month, each trader shall adjust its general positions in a futures contract held under its trading code to multiples of the number of lots of the delivery unit (a one-day extension is permitted in special market conditions); in the delivery month, the general positions as well as newly opened and closed-out positions shall be held in multiples of the number of lots of the delivery unit.

The rounding of the size of hedging positions in the futures contracts enumerated in the preceding paragraphs to multiples of a certain number of lots is made by reference to the foregoing paragraph.

To the extent of any inconsistency between these Risk Management Rules and the futures rules for the particular products, the product rules shall prevail.

Article 24 Percentage-based position and fixed-amount Position Limit for each futures contract at different stages of trading for a Member, OSP, Overseas Intermediary, and Client are governed by the futures rules for the particular products.

Article 25 The Exchange may adjust the percentage-based Position Limit of an FF Member based on its operating results.

The Exchange may adjust the percentage-based Position Limit of an FF Member, to no higher than thirty-five percent (35%), according to the rating of futures firms as per the CSRC’s supervision criteria.

Conditions for the adjustment of percentage-based Position Limits of FF Members and their specific position-based Position Limits, the period for imposition of such limits, and other matters will be notified by the Exchange.

Article 26 The Exchange may, based on market conditions, adjust the Position Limits for different listed products and contracts. Any adjustment to the Position Limit shall be reported by the Exchange to the Board of Directors of the Exchange, or the Board, and the CSRC, for approval prior to its implementation.

Article 27 The size of open positions held by a Non-FF Member or OSNBP shall not exceed the size of the Position Limit set by the Exchange; otherwise, the Exchange shall exercise Forced Position Liquidation subject to the applicable rules of the Exchange.

If the open positions held in aggregate by a Client through multiple trading codes opened with different futures firm Members (“FF Members”), OSBPs, or Overseas Intermediaries exceed the Client’s Position Limit, the Exchange shall instruct the FF Members or OSBPs to exercise Forced Position Liquidation of the excess positions of that Client.

An FF Member or OSBP shall not hold positions in excess of the Position Limit prescribed by the Exchange. Upon the reach or exceedance of such Position Limit, opening new position in that direction will be prohibited. When the aggregate open positions held by an Overseas Intermediary through one or more FF Members or OSBPs reach or exceed the Position Limit prescribed by the Exchange, opening new positions on the next trading day will be prohibited.

CHAPTER 5 TRADING LIMIT

Article 28 The Exchange applies Trading Limit. The term “Trading Limit” means the maximum size of positions opened by some or all of the Members, OSPs, and Clients in a contract within a certain period in accordance with the requirements of the Exchange. The Exchange may, based on market conditions, set the maximum size of positions opened within a day in different listed products and contracts for some or all of the Members, OSPs, and Clients. The specific criteria will be determined by the Exchange.

Hedging trades are not subject to the preceding paragraph.

CHAPTER 6 LARGE TRADER POSITION REPORTING

Article 29 The Exchange applies the Large Trader Position Reporting regime. Any Member, OSP or Client whose general positions in a futures contract reaches eighty percent (80%) or more of its Position Limit specified in the Exchange’s futures rules for the particular products, or any Overseas Intermediary whose general positions in a futures contract reaches sixty percent (60%) or more of its Position Limit specified therein, or upon request by the Exchange, shall report to the Exchange about its financial conditions, open positions, delivery intention, and other information. The Exchange may set and adjust the threshold, contents, and submission method of such reports according to market risk conditions.

Article 30 Any Member, OSP, Overseas Intermediary or Client whose positions reach the reportable level shall take the initiative to submit a report to the Exchange by 15:00 of the following trading day, and shall ensure the information in the large trader position reports and other related materials are truthful, accurate, and complete. The Exchange will notify relevant individuals if submission of a new or supplementary report is deemed as necessary.